Dear John Cochrane, you are hurting the economists who care about you

Matthew Martin

5/08/2016 04:17:00 PM

Tweetable

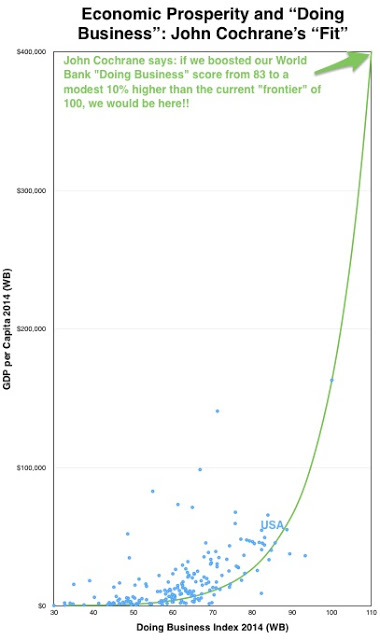

As Dr. Kelso would say, John Cochrane spent 4 years in undergrad and 5 years in grad school, so we can assume he is at least 9. It's extremely hard for me to understand how an 9 year old could make such an absurd claim: that a little bit of deregulation could single-handedly push the US from GDP of $55,000 per capita to $400,000 per capita.

Forget the econometrics for a moment and just look at the graph:

Statistics cannot be used to make claims about out-of-sample events. Economists sometimes weasel around this limitation by adding some theoretical assumptions: for example, if we assume that the relationship is continuously differentiable, then it follows that for some small range just outside of the sample, a naive extrapolation of the in-sample trend is a good approximation. But Cochrane is claiming that his relationship holds light years outside of his sample, with zero theoretical or empirical defense of this claim.

Brad DeLong offers some econometric arguments against Cochrane's claims. I say just look at Cochrane's data:

What's important to remember here is that the Cochrane's critics don't even disagree with his premise that the US would benefit from many kinds of deregulation. In a follow-up post, Noah Smith points us to his own arguments for that point. What we're criticizing is the claim that deregulation alone could push the US to GDP of $400,000 per capita, a claim that makes economists as a whole look stupid, if not dishonest.

I've always regarded Cochrane as a competent, prominent economist, and no doubt the readers of the Wall Street Journal do to. I don't follow finance econ so much, but I've usually found Cochrane's blog enlightening. I guess sometimes even the most highly competent economists say stupid things. One hopes that they wouldn't do so on a medium as widely read as the WSJ, and that they would admit their errors once it is pointed out to them and they have had time to reflect.

Anyway, in hopes of ending this post constructively, here's some competent, honest analyses on how much we can expect to benefit from various kinds of deregulation. There's lots to like about this analysis. Reasonable people can disagree over whether some of those estimates are a bit too high or a bit too low, but they are all defensible. All of the usual caveats about model specification and endogeneity and omitted variables and all the rest apply. But what's really great about it is that it actually identifies real-world regulations we could repeal or modify, not hand-waiving about hypothetically making it easier to do business in the US without naming a single regulation to change. That's much more helpful! That's how you start a constructive discussion about deregulation.