Obamacare insurance premiums aren't sustainable

Matthew Martin

10/25/2013 06:37:00 PM

Tweetable

The Affordable Care Act (aka "Obamacare") sets up five types of health insurance plans: catastrophic, bronze, silver, gold, and platinum. The latter four are regulated so that they must pay 60, 70, 80 and 90 percent, respectively, of your total healthcare expenses. The catastrophic plans have regulations on maximum out-of-pocket expenses and other things, but otherwise doesn't have a well-defined coverage requirement I can use for analysis, so I'm excluding that category in what follows.

Since we know the minimum coverage rates for each type of plan, we can use their premiums to get an idea of the amount of healthcare expenses insurers are expecting enrollees to incur, on average for each tier. The calculation goes like this: $$expected~average~cost \leq \frac{ 12 \left( monthly~premium \right)}{coverage~ratio}$$ The logic here is simple: an insurer won't offer an insurance plan at a premium where it expects to loose money on average, so we can use the premiums they offer to back out upper-bounds on how much they expect enrollees to spend on healthcare. We'll call the upper-bound the "break-even rate," since if actual expenses turn out to be higher than that rate, the insurer will loose money. Generally the break-even rate is around 20 percent higher than the actual expected costs--insurers want to earn profits--but that's immaterial here.

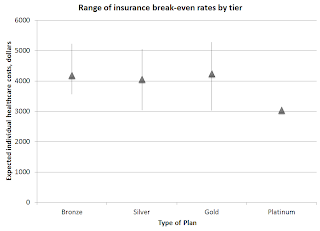

Here is a chart showing the spreads of break-even rates for plans in each tier (data includes all bronze, silver, gold, and platinum plans offered to me on healthcare.gov for which premiums were listed)

The triangle represents the average break-even rate for all the plans in that tier, while the lines signify the maximum and minimum break-even rates in the tier. Only one platinum plan was offered.

The thing that stands out about this chart is that the break evens are essentially the same in all four groups. Even the platinum plan--the only platinum plan was from Humana, and the break-even was very close to break-even rates for other Humana plans in the silver and gold tiers (they aren't offering a bronze plan). The variation within tiers has to do with inclusion of children, vision, and dental insurance, which understandably affect costs.

Let me reiterate: insurers aren't expecting any selection whatsoever. That's really surprising in light of research suggesting that we will see adverse selection within the healthcare exchanges. If you know you will have higher-than-average healthcare costs, at these prices it would be fairly foolish to go with anything other than the platinum or a gold plan. That means that those plans will attract high-risk pools, and insurers will loose money. Expect large hikes in premiums on platinum and gold plans in the future.

To be clear, all the premiums will rise at least somewhat, because healthcare costs will continue to rise, for everyone. But my point here is that the higher tier plans will have to rise disproportionately, as they will attract the least healthy individuals.