John Taylor admits that the Zero Lower Bound is real

Matthew Martin

7/04/2013 05:18:00 PM

Tweetable

Ok, for background, the ZLB refers to the fact that the Federal Reserve cannot theoretically lower nominal interest rates below 0%, because people would presumably refuse to buy any asset at a negative rate and simply hoard cash, which guarantees at a 0% nominal interest rate, instead. That has important implications because the interest rate is a factor in how much people decide to save and spend--at lower interest rates, people consume more and save less. Hence, if the nominal interest rate is zero, then the Fed cannot lower the interest rate any further, which means that cannot increase consumer spending. That's not a problem if people are spending as much as the economy is capable of producing, but if people aren't buying as much as the economy can produce, then that means that firms can't sell as much, and slash employment, which is called a recession. In such an environment, the Federal Reserve cannot adjust interest rate in response to the too-low spending, and we need to find alternative ways to boost employment, such as fiscal stimulus, and (somewhat more speculatively) quantitative easing programs that aim to raise inflation, which would reduce the real interest rate even while the nominal interest rate remains stuck at zero, thus increasing consumption spending.

However, in the past John Taylor has completely ignored all this. He has argued that the government should slash spending, that the Federal Reserve should not engage in quantitative easing, and even that the Federal Reserve should raise nominal interest rates immediately (recall that, raising interest rates means even less consumer spending). To defend these claims, he coauthored a paper in which he claims that enactment of GOP budget cut proposals (specifically the Paul Ryan budget proposal) will be expansionary in both the short run and long run. You read Noah Smith's critique of that paper here, or my critique here. (I have also aggregated other economists' comments on the paper here)

But here's the thing about that paper: it presumes that there is no zero lower bound, and that the Federal Reserve will react to government spending cuts by lowering the nominal interest rate. That is bad enough right there--if you add the restriction that interest rates cannot fall below zero in Taylor's own model, then you get the standard New Keynesian result Krugman has been talking his head off about: cuting government spending will reduce GDP and employment, while increasing government spending right now will increase GDP and employment now, with absolutely no adverse effects on long-run potential.

That's not all. As Miles Kimball pointed out, Taylor has also been arguing for the Federal Reserve to raise nominal interest rates immediately, and cease and desist all quantitative easing. Even without the ZLB, that policy combination is highly contractionary in Taylor's own model.

This post is all to say that while Taylor now tacitly admits he was wrong back then, he is still peddling all the same derp. The problem, Taylor now admits, is that in deep recessions his Taylor Rule--which is a formula that adjusts nominal interest rates so as to maintain full employment--predicts negative interest rates, which aren't feasible in the real world. So, he says, the Federal Reserve should adopt a "meta-rule" that would commit to keeping interest rates at 0% for an extended period after the recessionary episode, which should provide stimulative effects through the expectations channel.

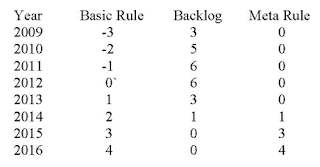

But here's the kicker. What does this new rule say we should do? Raise interest rates immediately! Seriously, here's the table from Taylor's post:

The first column is the interest rate predicted by his Taylor Rule (not too long ago he was arguing that for 2009-2012 the Fed was keeping rates below the Taylor Rule--I guess he changed his mind on that), and the third column is the rate predicted by his new "meta-rule," which he claims corrects for the ZLB problem. Notice that the rate for 2014 is 1%.

So Taylor's post really says "Yeah, I was wrong when I said we needed to raise interest rates before--but trust me, this time we really do need to raise interest rates!"

I'd compare Taylor to the boy who cried wolf, except that the allusion isn't quite right: the boy who cried wolf actually was correct once.