Should I rent or buy?

The burning question of whether policy should encourage home ownership over renting never quite dies out in the econ blogosphere. Alex Tabarrok caused the most recent conflagration with his February post "Economics on Owning vs Renting a House" which argued, in typical Marginal Revolution fashion, that ownership is overrated.

The conventional wisdom

The conventional wisdom disagrees (hence the "overrated" part). The New York Times typifies this genera:

The arguments in favor of ownership are persuasive, particularly for people who expect to stay in place for at least five to seven years but probably more. A mortgage acts like a forced savings plan, even if you’re paying the bank hundreds of thousands of dollars in interest for the privilege of building equity. Call it the cost of enforcing a positive behavior.

If you rent, all that money goes down the drain, while if you buy, that money goes into savings in the form of home equity, so they say.

Yet the conventional wisdom often leaves people with the wrong impression on how rent costs relate to ownership costs. On twitter, I tried to offer a rule of thumb to help conceptualize the comparison:

when you buy a house, you take out a mortgage. For own/rent comparison remember: interest=rent, equity=money you didn't invest in stocks.

— Matthew Martin (@hyperplanes) February 3, 2016

Obviously this ignores a lot of other things like taxes, which rent covers (so should say something more like tax+interest=rent).

But even with all the caveats, this is less helpful advice than it seems because you don't pay the same amount of interest each month, and because of compounding you can't just look at the average interest payment.

A numerical example

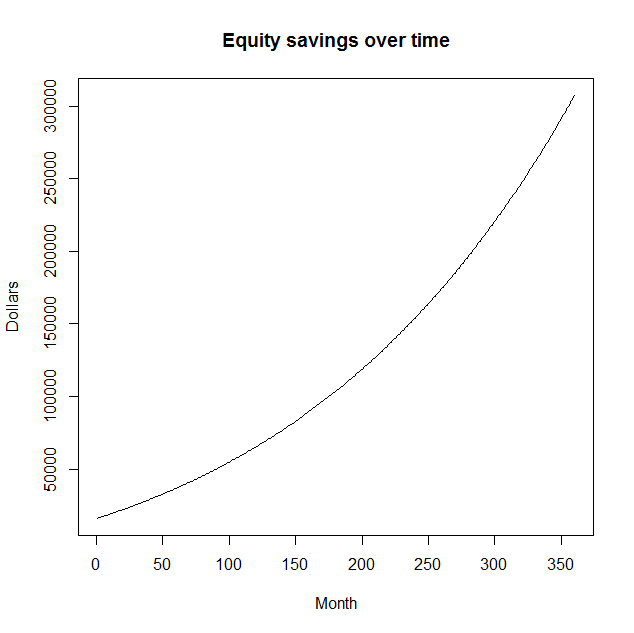

So here's a concrete comparison. A friend of mine recently bought a $176,500 house, put $15,885 down, and mortgaged the rest for 30 years at 3.6% interest. Taxes work out to $285 per month. In this area, the house will appreciate 3.57% each year. Counting the down payment and monthly payments, here's his equity savings value over the life of the mortgage (my R code here):

Of course, buying a house involves a ton of other expenses I'm not considering here—this is just a baseline.

Now suppose that you rent an apartment instead. Instead of home equity, you invest in a diversified stock portfolio at 7% returns per year. Given the same down payment (invested in stock) and monthly payments, here's how much appartment you can afford while building the same amount of savings as in the chart above:

To start, you need an appartment for less than $813 a month to build the same amount of wealth. Eventually, because of the higher returns from stocks, you can afford up to $1160 per month by skimming some of the returns off the top of your stock portfolio. If you consistently rent for less than these amounts, you would end up with more savings than if you purchased the house.

Rent/Mortgage comparison calculator

Calculator

Update (7/8/2016): Looks like New York Times has a more detailed but very similar calculator here.

Conclusion

Comparing a house versus a totally equivalent rental property, the ownership will probably cost a bit less most of the time. Although my friend previously paid less than the $813 for his two bedroom appartment, his $1015 per month mortgage probably affords a nicer house than any $812 per month apartment he could find so apples-to-apples ownership probably costs a bit less. On the otherhand, the ownership incurs more risk than a diversified stock portfolio—he will experience more difficulty moving, and must bear sector-specific risks that a stock portfolio can diversify against. Making the rent-equivalence and home equity comparison explicit helps guide your decision on whether the risk premium adequately compensates the extra risk you bear as a homeowner rather than renter.