Bad jobs report, good wage report?

Matthew Martin

4/03/2015 03:27:00 PM

Tweetable

On the other hand, wages rose. As Danny Vinik notes:

"What’s even more interesting in this report is that wage growth actually beat expectations, rising 0.3 percent in March versus the expected 0.2 percent. In the past year, wages have grown 2.0 percent. That’s only a slight beat and can be attributed to the noisy report. Yet it’s still tough to square a slight increase in wages with the ugly jobs numbers. It’s a complete reversal of the narrative that we’ve seen over the past year where the jobs numbers repeatedly came in above 200,000 yet wage growth was muted. Simply put, it doesn’t make any sense!"According to Vinik, wage growth contradicts the bad jobs growth.

Theory predicts that wages growth should rise as labor markets tighten, and decline in weak labor markets, and I don't dispute that. However, I'm on record criticizing people who made a big deal out of wage growth in the past monthly reports because, in my view, wage growth seems to be too persistent for that kind of analysis--any month-over-month change in wages is far more likely to be noise than signal.

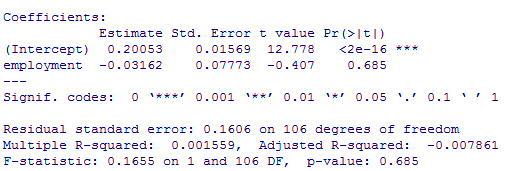

So, here's a few simplistic regressions to help think about the correlations:

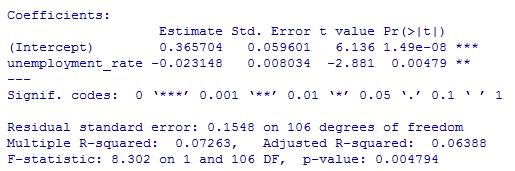

The unemployment rate, on the other hand, is actually predictive of the changes in wages.

And just to complete the thought, here's what we get if we look at the change in unemployment instead of the level:

I'm not saying that strong labor markets don't lead to wage increases. But clearly we won't be able to see this relationship in real-time monthly datapoints. All of that commentary is just tilting at statistical noise, not actual economic indicators, in my opinion.