Economic mobility is irrelevant

Matthew Martin

5/26/2014 08:00:00 AM

Tweetable

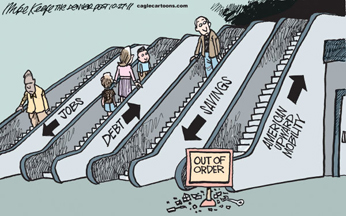

First, we have to ask what we mean by "mobility." Conservative critics of Piketty invariably point to research which examines mobility by movement between percentiles of the wealth distribution. That is a critical distinction because it relies on the assumption that the level of inequality is relatively constant over time--otherwise, if inequality is rising over time, then a percentile is not a consistent unit of measurement between time periods. That's because rising inequality implies compression of the lower percentiles of the income distribution. Here's an example to illustrate the point. Suppose that in period 1 the wealthiest 1 percent of households own 10 percent of the wealth, while that share increases to 50 percent of the wealth in period 2. If you were in the 90th percentile in period 1 and moved up to the 10th percentile in period 2, then these studies of income mobility would classify you as extremely mobile, and if that experience is a common one, they'd conclude that class mobility is extraordinarily high in this economy. However, the share of total wealth going to the bottom 99 percent actually shrank by 44 percent, meaning that even though you moved way up in terms of percentile, you actually moved way, way down in terms of share of total wealth you own.

Which brings me back to the model of immiseration in my previous post. Recall that households invest in risky capital projects. If such projects are sufficiently risky, meaning that they have a chance of really big returns and a chance of really big losses, then the class mobility, as measured by percentiles, will actually be huge in that model--potentially way more mobile than the US actually is. Nevertheless, immiseration will still inevitably takeover: a vanishing share of households will take an ever-increasing share of the wealth, until at some point one household owns all wealth, and everyone else starves. In fact, in such a model, "mobility"--as others have defined it--may well increase with time, even as almost everyone becomes impoverished, because the riskiness of each individual investment is constant over time, so that a positive payout in a later period will bump a household up more percentiles than the same payout in an earlier period, which would appear as increased mobility.

Therefore, one implication of the immiseration result in the mechanism design literature is that all studies of mobility across wealth percentiles (like this one) should be sent straight to the trashcan. They're utterly, indefensibly meaningless if they do not explicitly examine the percentage of total wealth owned by each percentile. In short, the task for empiricists is to examine whether immiseration is happening--Piketty has some empirical evidence that it is (we'll wait and see if those errors change anything)--and if it is in fact happening, then we have little choice but to adopt Piketty's proposal for a wealth tax or some similar mechanism to break the immiseration equilibrium path. Almost everyone's livelihoods--capitalists and laborers alike--depend on it.

[Side note: this rebuttal was inspired a while ago by this WSJ post (update: link corrected) which suggests that conservatives should argue against Piketty by claiming that Piketty's policies would reduce economic mobility. Such a claim would be totally unfounded, but even if it were true, it's far from clear that economic mobility is good, or that a reduction in mobility isn't an improvement.]