Treasury Issues Floating-Rate Bonds

Matthew Martin

5/05/2013 10:47:00 AM

Tweetable

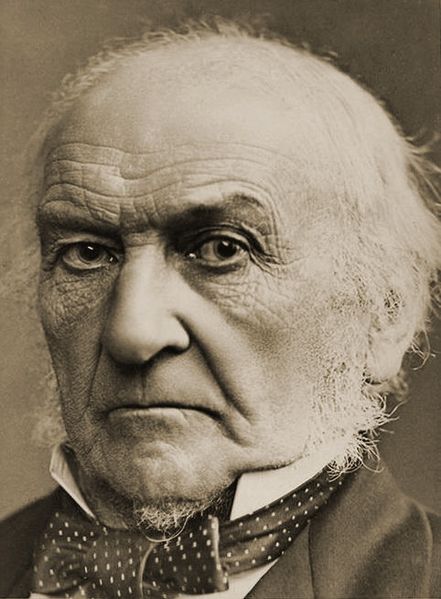

Update: I now see that in my zeal to relate this topic to Gladstone and Disraeli, I misread the nature of the Treasury's proposal. They will be issuing floating-rate bonds, but they will be fixed-maturity rather than perpetual. John Cochrane and I both believe they should make these into perpetual bonds--what follows is a discussion of perpetual bonds, with a blurb about floating rates and financial risk at the end.Via John Cochrane, it appears the Treasury will now start issuing

For those who are unfamiliar to the concept, a perpetual bond is a debt instrument where the treasury borrows money by selling the rights to a stream of interest payments to be made monthly forever, with no plans to ever repay the principle. See the UK consol for an example. By contrast, fixed-maturity bonds are where the treasury borrows money by selling the rights to a repayment of a fixed sum (generally \$1000) at a fixed date in the future (the bond is said to "mature" on that date). In principle, these are equivalent schemes. While you can troll the Miller-Modigliani theorem for this result, I think it is simpler to see why by just considering the case where the treasury issues a perpetual bond and buys it back after a fixed amount of time--there is no inherent reason investors should charge more or less interest to do it this way than to borrow the same principle with a bond that matures after the same amount of time.

I'm not entirely clear on why perpetual bonds are cheaper than fixed maturity, given that in principle they should be basically the same. My suspicion is that financial repression is a big part of the story--if you are going to coerce a bank into lending money to the government at below-market rates, then the perpetual bond is going to be more lucrative than a short-lived bond. There is also likely to be administrative savings from perpetual bonds, since, as Cochrane notes, the government would no longer have to roll over a few trillion dollars worth of bonds every few weeks. That means that the treasury can cut staff and computation resources, and also means that private investors can do the same, thus reducing the interest rate they would demand.

I think Cochrane's point--that the treasury should just convert all long-term debt into perpetual bonds--is spot on. To the extent that we issue finitely-lived bonds to pay for indefinitely-lived debt, we are really just being dishonest and, apparently, paying a non-trivial premium to do so. However, I think that most of Cochrane's reasoning about risk is baloney.

I'm not entirely clear on why perpetual bonds are cheaper than fixed maturity, given that in principle they should be basically the same. My suspicion is that financial repression is a big part of the story--if you are going to coerce a bank into lending money to the government at below-market rates, then the perpetual bond is going to be more lucrative than a short-lived bond. There is also likely to be administrative savings from perpetual bonds, since, as Cochrane notes, the government would no longer have to roll over a few trillion dollars worth of bonds every few weeks. That means that the treasury can cut staff and computation resources, and also means that private investors can do the same, thus reducing the interest rate they would demand.

I think Cochrane's point--that the treasury should just convert all long-term debt into perpetual bonds--is spot on. To the extent that we issue finitely-lived bonds to pay for indefinitely-lived debt, we are really just being dishonest and, apparently, paying a non-trivial premium to do so. However, I think that most of Cochrane's reasoning about risk is baloney.

First, Cochrane suggests that perpetual bonds eliminate the risk of the run on the treasury. I get the logic--if the treasury doesn't have to roll over debt, then the risk of not being able to borrow to roll over the debt is gone. But there are two critiques. For one, the general lesson of the past half-decade is that countries can only experience runs on their debt if they lack their own currency. We have our own currency, so the Fed can completely insure against a run. That destroys the run equilibrium completely. Furthermore, if we lacked our own currency, I doubt seriously whether perpetual bonds would really be immune to a run--if doubts exist on the government's solvency, then interest rates would balloon on both new and outstanding debts, so we still get essentially the same bank-run-type panic and immediate default.

But Cochrane goes further to assert that floating-rate perpetual bonds "opens the way to a run-free financial system." The reasoning is this, by floating the interest rate on the bond, the government can guarantee that the market price of the bond is constant (though, as Cochrane admits, this isn't quite what the treasury intends to do). That means that it provides financial intermediaries with an instrument whose value cannot (in theory) fluctuate, providing the perfect insurance against risk. I can see how holding this highly-risk-free asset in reserves could reduce the firm's risk somewhat, but then Cochrane suggests that

"the Treasury can swap out the interest rate risk with fixed-for-floating swaps. Who will buy those swaps? The same people who are buying long-term Treasuries now."In the very next breath after advocating shifting risk from investors to the government, Cochrane undoes that by advocating that we shift the risk right back to literally "the same people." This is a zero-sum game: putting the fixed-price perpetual bonds on bank balance sheets shifts risk from banks to the government, while putting fixed-for-floating swaps on bank balance sheets ships that very same risk right back at them. Perhaps even while increasing bureaucratic costs in the process. And besides, if we want to insure the government against interest-rate risk, all we have to do is sell fixed-rate perpetual bonds, which is exactly what Prime Minister Pelham did way back in 1752--at a pretty decent 3.5% interest rate, too.

In conclusion, Cochrane needs to decide whether he wants the government or the private sector to bear that risk. If we think that moral hazard and government solvency are not problems, then it is generally optimal for the government to bear that risk. If moral hazard is a big problem, then public insurance (shifting the risk to the government) is sub-optimal. And obviously, if the government is likely to become insolvent then it can't really insure that risk anyway.

Lord

5/05/2013 01:39:00 PM

I can see value in both. Some buyers will be concerned with liquidity and value of the bonds, and others will be concerned with the stability and value of the income stream from them, though these will not be the same buyers. The former are concerned with capital risk and the latter with income and reinvestment risk. It is likely the government does best with the former, but could do well with the latter if appropriately priced and willing to absorb the volatility that goes with it. That may be too much to hope for but if they cannot accept the risk, no one else should. (This is beyond any legalities that might afford treasury more flexibility with swaps than debt.)