What's all this fuss about "financial crises" anyway?

Matthew Martin

10/18/2012 11:53:00 AM

Tweetable

The econosphere's ablaze with a new debate over whether weaker recoveries tend to follow "financial crises" relative to garden-variety recessions. Let me point you to John Taylor here, here, and here, John Cochrane here, and Krugman here. Both sides lay claim to academic research in their favor, with studies by economists Reinhart and Rogoff showing that financial crises have weaker recoveries, while a study by economic historians Bordo and Haubrich attempting to discredit the the former. Both sides agree on a few facts:

- We are currently recovering from a financial crisis.

- Financial crises cause recessions to be deeper than garden-variety recessions.

- The current recovery is weaker than garden-variety recessions.

While I totally disagree with John Cochrane's view (see link above), he does offer a breath of fresh air by noting that both sides lack any meaningful research on the political issue we really care about--even if financial crises tend to precede weak recoveries, this says nothing about whether to blame Obama's policies for the weakness of the current recession. Moreover, all of the studies in question look only at averages, while the data displays a huge amount of variance around the average.

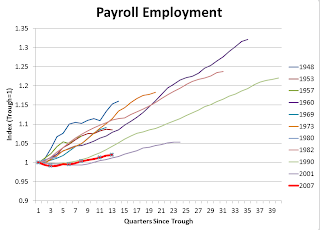

I respectfully submit that both sides are being complete idiots on this issue. They claim to be macroeconomists, but apparently haven't looked much at the data. I've compiled some charts to help them:

Each graph shows the post-recession paths of real GDP, employment, and the employment-population ratio, respectively, for each of the recessions since the BEA first started releasing quarterly data in 1947. Indeed, when you look at each measure, the current recovery ranks dead last compared to the previous 10 recessions. But look more closely: in second to last place we have the 2001 recovery, third to last is the 1990 recovery...Which recoveries were the best? In first place is 1948, while second place goes to 1957. The big point everyone seems to have missed is that recoveries from recessions have been getting weaker over time. Relative to the 1990 and 2001 recessions, the current recovery looks completely normal, and all three are exceptionally weak compared to all of the earlier recoveries. In light of that feature, all the talk about financial crises looks like spurious correlation to me, especially since the financial sector has become a much larger portion of the economy over time.

Now, I will postulate a few additional critiques. First, recessions prior to the abolition of the gold standard and implementation of the FDIC in 1933 are completely irrelevant, because they were mostly caused by the gold standard itself, and always precipitated financial crises because of the lack of deposit insurance. Second, "financial crisis" is an entirely meaningless term, since all recessions are to some degree financial crises. If they did not involve financial losses, they wouldn't have been recessions. Third, the whole debate is pretty meaningless, because it is devoid of actual policy implications. As Cochrane points out, weak recoveries being correlated with financial crises could still imply that Obama's policies are to blame. Or it could also be the case that financial crises have nothing to do with it, but Obama couldn't have done any better. Finally, we simply don't have enough recessions in our data sample to claim any statistical significance. Even if the p-value is small, there is tremendous bias since we simply do not have enough data in the sample to obtain proper identification taking into account all the different types of variation in the data.

Unknown

10/21/2012 07:00:00 PM

B.S. this crises was caused by guys like chris dodd and that fat fag barny frank,suing banks that would not lend to minority's and illegal alien's.people that never should have gotten a loan.and the obama administration's crony capitalists timothy geithner bailing out big banksters,at the expense of the middle class homeowners.